When you step into the world of accounting, one concept that you can’t escape is the distinction between debits and credits. It’s a fundamental principle that forms the backbone of financial record-keeping. But what do these terms really mean?

Let’s dive in and uncover the mysteries behind debits and credits, and answer the burning question: is dividends a debit or credit?

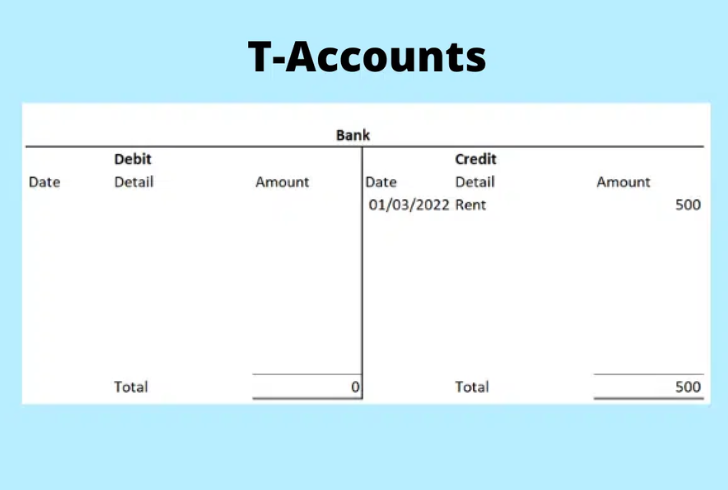

The T-Account

At the heart of accounting lies a simple yet powerful tool: the T-account. This visual representation splits each account into left and right sides, resembling the letter “T”. A debit is recorded on the left side, while a credit is recorded on the right. As transactions occur, one side increases while the other decreases. To find an account’s balance, you calculate the difference between its debits and credits.

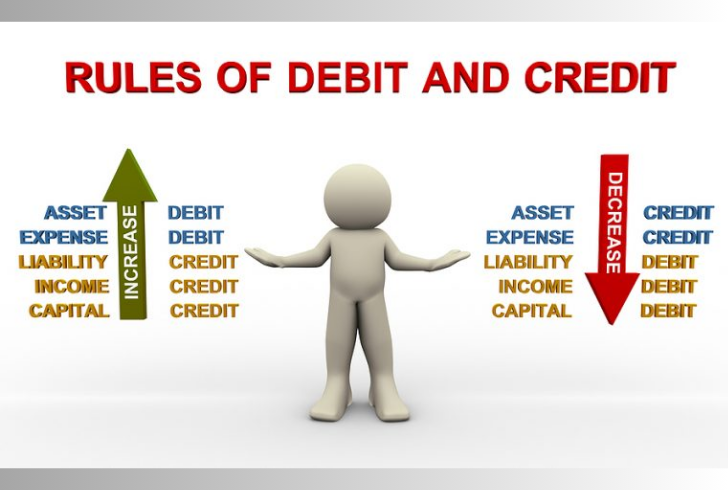

A Closer Look at Debits and Credits

Debits and credits are the bread and butter of accounting. While we often see these terms represented as DR or dr for debit, and CR or cr for credit, it’s essential to understand their impact on different account types.

- Assets and Expenses: Both these accounts increase with a debit and decrease with a credit. For example, when you buy office supplies (an asset), it increases with a debit.

- Liabilities and Equity: These accounts operate oppositely. Liabilities increase with a credit and decrease with a debit. Similarly, equity accounts like Common Stock increase with a credit and decrease with a debit.

Normal Balance: The Expected Path

Each account has an expected direction called “normal balance”: assets and expenses are debits, while liabilities, equity, and revenues are credits.

Each account has a “normal balance,” which is the expected direction it moves. For assets and expenses, the normal balance is a debit. In contrast, liabilities, equity, and revenues maintain a credit normal balance. Here’s a breakdown:

- Asset: Debit (Increases with Debit)

- Liability: Credit (Increases with Credit)

- Common Stock: Credit (Increases with Credit)

- Dividends: Debit (Increases with Debit)

- Revenue: Credit (Increases with Credit)

- Expense: Debit (Increases with Debit)

Abnormal Balances: When Things Go Awry

Sometimes, an account may produce a balance that doesn’t align with its normal balance, known as an abnormal balance.

Consider this scenario: if an Accounts Payable account has a credit of $4,000 and a debit of $6,000, the resulting debit balance of $2,000 is abnormal. This could occur due to an overpayment or recording error.

Is Dividends a Debit or Credit?

The question that often perplexes many is, “Is dividends a debit or credit?” Dividends are a distribution of profits to shareholders, and they are recorded as a debit in the accounting books. This means that when a company pays out dividends, it decreases its retained earnings, which is an equity account.

Wrapping It Up

Understanding the rules of debit and credit is crucial for anyone venturing into the world of accounting. Whether you’re a business owner, student, or someone curious about finances, grasping these fundamentals will empower you to make informed financial decisions and interpret financial statements with confidence.

So, the next time you come across terms like DR, CR, or wonder about dividends, you’ll have a clear understanding of their roles and impacts in the financial landscape. With this knowledge in hand, you’re well-equipped to navigate the complexities of accounting and ensure accurate and meaningful financial reporting.